In decentralized finance (DeFi), keeping up with market trends and tokens is overwhelming. Especially as decentralized exchanges (DEXes) continue to grow in popularity. This is where DEXTools steps in. DEXTools is a platform designed to simplify trading on DEXes. It offers real-time data on liquidity pools with advanced analytics across multiple blockchains.

Whether you’re a seasoned trader or just starting your journey, DEXTools can significantly improve your trading experience.

With support for over 70 networks, including Ethereum, Base Chain, Solana, Binance Smart Chain, and many others, DEXTools provides extensive access to trading information on liquidity pools. This support makes it easier for users to track and manage trades across various ecosystems. DEXTools is also community-focused, with the team integrating user feedback and supporting initiatives like DEXTForce and DEXTForce Ventures, creating an ecosystem that’s built around its user base.

DEXTools Mission and Vision:

- Mission: “To be the standard for insights, trading capabilities, cross-platform interoperability, consumer protection, and crypto education.”

- Vision: DEXTools aims to simplify decentralized trading, making opportunities accessible to everyone.

The DEXT token and its role in the ecosystem

The DEXT token is the native utility token within the DEXTools ecosystem. It allows users to unlock premium features and participate in community-driven initiatives, such as DEXTForce Ventures. The token operates on both the Ethereum (ERC20) and Binance Smart Chain (BEP20) networks.

- Max supply: 200,000,000 DEXT

- Total Supply: 120,551,255 DEXT

- Circulating Supply: 77,822,920 DEXT (39.9% of total supply)

- Deflationary Model: A portion of DEXT is burned monthly from platform profits, reducing the total supply over time

Users can either stake DEXT to access premium features or pay a monthly subscription fee. The token’s deflationary nature and its role in accessing valuable platform features contribute to its long-term value within the ecosystem.

DEXTools offers three subscription plans to meet user needs:

Free Subscription

- Pool Explorer: Allows users to track liquidity pool movements and the creation of new pools across DEXs.

- Pair Explorer: Provides in-depth charts, transactions, and trust metrics for token pairs.

- Big Swap Explorer: Tracks significant transactions, often made by “crypto whales,” to help identify potential market trends.

- Multiswap: Lets users trade multiple tokens simultaneously by connecting directly to different DEXs’ APIs, streamlining trades.

- Aggregator: Enables trading directly within the DEXtools app across various DEXs, all in one interface.

- 10 Hot Pairs & Favorite Pairs: Shows trending token pairs and lets users save up to 10 favorite pairs for quick access.

- Desktop Price Alerts: Receive real-time price notifications straight to your desktop.

- Real-Time Data & Charts: Access up-to-date market data and charts for informed trading decisions.

Standard Subscription (make a monthly transfer worth $19.90 in DEXT token or hold 1,000 DEXT)

- Wallet Info: Track and analyze the wallets of top traders, including their transactions and token holdings.

- My Positions: Track your portfolio’s performance, including profit and loss (P&L) over time.

- Enhanced Price Alerts: Get notified of price changes via desktop, email, or Telegram.

- Limit Order & Trading Bot: Automate your trading with advanced tools.

- 12 Hot Pairs: Monitor additional trending token pairs.

- No Ads: Enjoy an uninterrupted, ad-free experience.

- Trade Analytics: Deep-dive into market data to refine your trading strategies.

- Unlimited Favorite Pairs: Save as many favorite pairs as you like.

- DEXTForce Discord: Engage with the DEXTools community through an exclusive Discord channel.

Premium Subscription (hold 100,000 DEXT)

- All Standard Features plus DEXTForce Ventures for exclusive DeFi investment group access.

- Extended Tracking: Track up to 15 Hot Pairs for even deeper market insights.

- Premium Discord Access: Join the premium community for advanced insights and discussions.

- DEXTShare Program: Earn a share of the platform’s subscription revenue through this reward program.

Navigating DEXTools Plans: Choosing the right fit

Selecting the right DEXTools plan is essential for maximizing the platform’s potential. Here’s a breakdown of how each subscription level meets different trading needs:

- Free Plan: Ideal for casual traders or beginners, this plan provides access to core features like Pair Explorer, Pool Explorer, and basic analytics.

- Standard Plan: Suitable for intermediate traders who need advanced alerts, wallet tracking, and portfolio management. For those holding 1,000 DEXT, the additional tools provide substantial value in terms of data depth.

- Premium Plan: Designed for professional traders or institutions with 100,000 DEXT, this plan provides exclusive access to DEXTForce Ventures and a revenue-sharing program, adding layers of investment and community support.

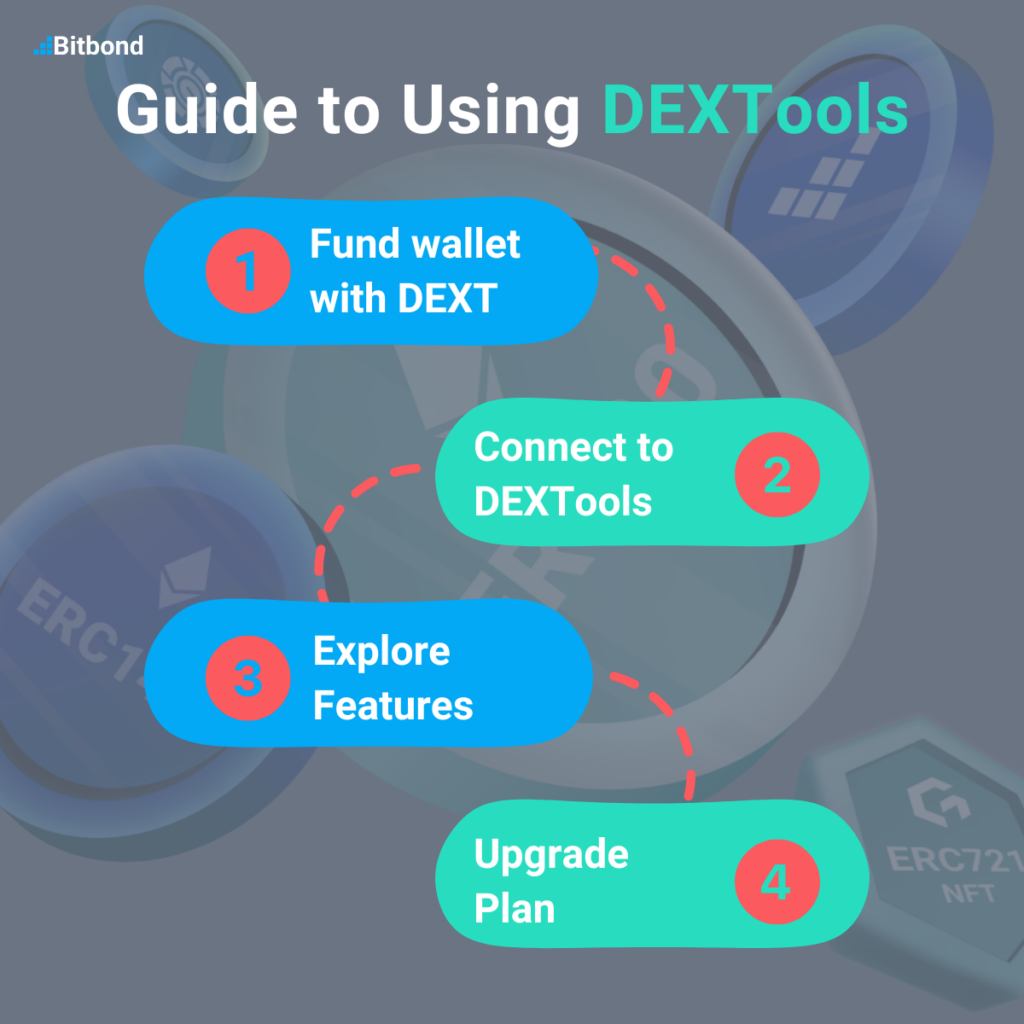

- Set Up Your Web3 Wallet: Prepare a cryptocurrency wallet like MetaMask or Phantom and fund it with tokens.

- Connect Your Wallet: Visit the DEXTools website and click “Connect App.” Choose your wallet and verify the connection.

- Explore Features:

- Use Pair Explorer to check charts, liquidity pools, and transaction history.

- Track large transactions with Big Swap Explorer to identify whale activity.

- Streamline trades using Multiswap, trading up to 10 tokens simultaneously.

- Upgrade for More Features: Access premium tools like Wallet Info, Trading Bots, and P&L tracking by holding or staking $DEXT.

Advanced trading features offered by DEXTools

DEXTools goes beyond basic features with advanced tools for experienced traders. Here’s a look at some of its standout features:

- Price Alerts: Set up notifications through desktop alerts or Telegram channels for crucial price changes.

- How to create a price alert:

- Go to the token pair page within the DEXTools app.

- Add it to your favorites.

- Click on the “price alerts” tab under the chart.

- Activate the desired alert in your configuration (desktop notifications or Telegram).

- Click on “+ Add price alert”

- Configure and confirm your settings to submit a price alert.

- How to create a price alert:

- In-App DEX Integration: Trade within the app, eliminating the need to navigate across multiple platforms.

- How to trade within the app:

- Connect your cryptocurrency wallet (e.g., MetaMask) to the DEXTools app.

- Click on the “DEXTswap” button on the left

- Select pair to swap and confirm trade

- How to trade within the app:

- Embedding: Place DEXTools charts on external sites, extending visibility and accessibility:

- How to embed DEXTools charts on external websites:

- On the right of the pair name on the chart look for the social button next to the star.

- Copy the embed code provided by DEXTools.

- Paste this code into the HTML of your external website or blog.

- The chart will now appear and update in real-time on the embedded page.

- How to embed DEXTools charts on external websites:

- Real-Time Data & Analytics: Access live metrics on trading volume, liquidity, and price movements, critical for timely decisions:

- How to use real-time data & analytics:

- Open the Pair Explorer or Pool Explorer within DEXTools.

- Select the token pair or liquidity pool you’re interested in.

- View real-time updates on trading volume, price movements, and liquidity directly from the charts.

- Utilize the provided technical analysis tools (e.g., moving averages, MACD) to make informed decisions based on live data.

- How to use real-time data & analytics:

Deep Dive: key features and their use cases

Each of the features offered by DEXTools serves a specific purpose in enhancing trading strategies. Here’s an in-depth look at how these tools are used by different types of DeFi participants:

1. Pair Explorer in Action

- Use Case for Traders: Pair Explorer offers token-specific details, historical price movement, volume, and market sentiment. Traders can compare these insights across similar pairs to identify profitable trade opportunities.

- Use Case for Liquidity Providers: LPs can monitor liquidity and trade activity within pools, helping them gauge the demand for specific tokens and optimize their positions accordingly.

2. Big Swap Explorer

- Identifying Trends with Big Swap Explorer: The Big Swap Explorer is ideal for tracking “crypto whales” or significant trades that could influence market trends. This tool lets traders understand how major holders move in and out of positions, revealing potential price trends.

- Spotting Market Manipulation Risks: Since large trades can significantly impact token price, Big Swap Explorer helps traders avoid tokens with suspicious, large, or irregular trades.

3. Multiswap for Efficient Portfolio Management

- Streamlining Portfolio Adjustments: By enabling simultaneous trades, Multiswap helps investors quickly adjust their portfolios in response to market changes.

- Reducing Costs: The ability to execute trades across different pairs with fewer transactions reduces gas fees and enhances transaction efficiency, an important factor in blockchain trading.

Technical Analysis on DEXTools: Maximizing chart capabilities

Technical analysis (TA) is fundamental for predicting market behavior. Here’s how traders leverage DEXTools’ charting capabilities for advanced TA:

- Customizable Indicators: DEXTools allows users to apply indicators like moving averages, RSI, MACD, and Bollinger Bands directly within the chart. By customizing these indicators, traders can gain insights into market momentum and trend direction.

- Time Frame Adjustments: The ability to view price changes across different time frames (e.g., hourly, daily, weekly) enables traders to make informed decisions based on short- and long-term market behavior.

- Candlestick Patterns and Volume Analysis: DEXTools’ charts reveal patterns such as “head and shoulders” or “double tops,” which are essential for anticipating reversals. Volume analysis alongside candlestick patterns can highlight periods of high buying or selling pressure.

How to customize alerts for your trading style

Setting up timely alerts is essential for responsive trading, and DEXTools’ alerts are customizable based on specific needs:

- Price Alerts for Swing Traders: Swing traders often rely on price alerts to take advantage of short-term price fluctuations. Setting alerts for specific price points helps them capitalize on quick movements without constant monitoring.

- Volume Alerts for Whale Watching: Volume alerts signal changes in trading activity, which may indicate significant market moves or whale trades. Traders use this to predict potential shifts in market direction.

- Telegram and Desktop Alerts: DEXTools provides both desktop and Telegram alerts, which are essential for staying informed in real time. By customizing delivery methods, users can ensure they never miss a critical alert.

In this video you can learn how to set up alerts:

Optimizing Liquidity with DEXTools

For liquidity providers, DEXTools offers vital insights into liquidity pool performance across various DEXs. By analyzing key metrics and pool activity, providers can make informed choices on fund allocation, thereby maximizing returns and improving capital efficiency.

Here are specific steps to help optimize your returns as an LP using DEXTools:

1. Monitor Liquidity Pool Metrics:

- How to do it: Use DEXTools’ Pool Explorer to monitor liquidity pool metrics like total value locked (TVL), 24-hour trade volume, and the number of transactions. Pools with high trading volume but relatively low liquidity may offer greater rewards, as fees are shared among fewer participants.

- What to look for: Choose pools with high TVL and trade volume, as these tend to offer higher fee revenue. Look for pools with relatively balanced liquidity to avoid significant impermanent loss.

2. Evaluate Trade Volume & Volatility:

- How to do it: Use the Pair Explorer to analyze trade volume and price volatility for specific token pairs in a pool.

- What to look for: High trade volume in a stable pool can generate consistent fees, while high volatility can lead to impermanent loss. Prioritize pools with stable, high trade volumes where token prices aren’t fluctuating wildly.

3. Compare Different Pools Across DEXs:

- How to do it: DEXTools supports multiple blockchains and DEXs. Use the platform to compare different pools across DEXs like Uniswap, SushiSwap, PancakeSwap, and more.

- What to look for: Look for pools offering higher annual percentage yields (APY) on less congested DEXs. Lesser-known DEXs might provide better returns with fewer LPs competing for rewards.

4. Watch for New Pool Opportunities:

- How to do it: Use Pool Explorer to keep track of newly created pools and their initial performance.

- What to look for: Early entry into new liquidity pools can be advantageous because fewer LPs mean more fees for you. However, monitor the pool’s performance closely for signs of risk or low liquidity.

5. Monitor Impermanent Loss Risk:

- How to do it: Use DEXTools’ price tracking and liquidity depth tools to monitor token price movements.

- What to look for: Be aware of pools with high price volatility between token pairs, as significant price differences can lead to impermanent loss. Choose stable or correlated token pairs to minimize risk.

6. Rebalance Your Liquidity Positions:

- How to do it: Track your liquidity pool’s performance regularly using DEXTools’ P&L tracking and Trade Analytics.

- What to look for: Based on your profit and loss, decide whether to add more liquidity to high-performing pools or remove it from underperforming ones. Rebalancing regularly can help you stay in the most profitable pools while avoiding unnecessary risk.

7. Utilize Alerts for Liquidity Changes:

- How to do it: Set up price and volume alerts for token pairs you’re providing liquidity for.

- What to look for: Alerts can notify you of major changes in liquidity, trade volume, or price, allowing you to act quickly—either by adding more liquidity to take advantage of increased fees or withdrawing before impermanent loss worsens.

By following these steps, liquidity providers can use DEXTools to make informed decisions about where and when to allocate funds, minimizing risk while maximizing returns across different pools and DEXs.

Understanding Liquidity Pool dynamics

Here’s how DEXTools helps traders and liquidity providers understand and benefit from these pools:

- Liquidity Provider Insights: DEXTools provides pool-specific analytics that let LPs monitor metrics like total value locked, daily trade volume, and overall activity. These insights help determine if a pool is likely to provide high returns.

- Avoiding Impermanent Loss: Impermanent loss can impact LPs when the price of tokens within the pool changes. DEXTools helps LPs gauge risk by providing real-time data on liquidity and price fluctuations, reducing exposure to potential losses.

How DEXTools supports risk management

One of DEXTools’ major advantages is its ability to support traders in managing risk. Here’s how different tools contribute to a well-rounded risk management strategy:

- Whale Tracking: Tracking whales helps traders avoid volatile price movements and market manipulation, a common risk in DeFi markets.

- Real-Time Analytics: Having access to real-time data mitigates risks by providing up-to-the-minute information on token prices, trading volume, and market depth.

- Limit Orders and Trading Bots: By automating entry and exit points, limit orders and trading bots help traders avoid emotional trading, sticking to their strategy regardless of market noise.

How to use the pair explorer

The DEXTools Pair Explorer allows users to monitor and analyze token pairs across decentralized exchanges (DEXs). It offers a range of metrics, including price, liquidity, and transaction history, which are vital for traders and liquidity providers. Using these features effectively can help optimize your trading strategies and provide deeper insights into token behavior. Let’s walk through these features for this token pair as an example.

Key Metrics Overview

When you first open the Pair Explorer, you’ll see a range of key metrics on the left side. These are the essential KPIs (Key Performance Indicators) you should pay attention to:

- Market Cap: Indicates the total value of the token in circulation, calculated by multiplying the current token price by the circulating supply. In the screenshot the token’s market cap is $347.48K. This value gives an idea of the project’s scale and maturity.

- Liquidity: Shows the amount of funds available in the liquidity pool, here indicated as $59.6K. Liquidity is crucial because it reflects how easily a token can be traded without significant price fluctuations (slippage). Higher liquidity means smoother trades.

- Circulating Supply and Total Supply: These indicate how many tokens are currently circulating and the total maximum supply. In this case, the circulating supply is equal to the total supply of 995.66M tokens.

- 24H Volume: Displays the total amount of trading activity in the last 24 hours, showing how actively the token is being traded. Here, the 24-hour volume is $18.17K, suggesting moderate interest in the token.

- Holders: Refers to the number of unique wallet addresses holding the token. This token has 326.7K holders, which is a strong indication of a broad user base.

- Volatility: Volatility measures the degree of variation in a token’s price. A higher volatility score indicates a more erratic price movement. For this token, the volatility is 0.3045, signaling moderate price swings.

Liquidity and Locked Liquidity

Liquidity is a vital metric for understanding the market depth of a token. In the provided screenshot we see that liquidity is $59.6K. However, DEXTools warns that locked liquidity has not been detected. Locked liquidity refers to the portion of liquidity that has been secured and cannot be withdrawn by the project owners, which helps prevent rug pulls (a type of scam where developers remove liquidity, crashing the token price).

To verify locked liquidity, DEXTools provides external links to platforms like UNCX, DXSale Lock, Team Finance, and Floki Lock, where you can check if liquidity is locked. Locked liquidity reassures investors that their funds are safer, as liquidity cannot be removed from the pool for a set period.

Price Chart and Trading Volume

The price chart in the center of the screen allows users to track real-time price movements and adjust the timeframe (e.g., 15 minutes, 1 hour, 1 day) to suit their needs. In here the price fluctuates between $0.0003495 and $0.0003427, showing a 33.28% increase in the past 24 hours. The chart is essential for identifying trends like potential support (where the price consistently rebounds) or resistance levels (where the price struggles to break through).

In addition to price, the volume bars at the bottom of the chart show the amount of tokens traded at each price point. High volume during a price increase can indicate strong buying interest, while high volume during a price drop could suggest significant selling pressure.

Transaction History

The transaction history at the bottom of the screen provides a list of recent buy and sell orders. This allows you to observe market sentiment in real-time. For example, if you see a lot of large buy orders coming in, it could signal that traders expect the token’s price to rise, while multiple large sell orders might indicate a looming price drop.

Viewing Other Pools for the Same Token

To see if the token is available in other liquidity pools, you can click on “View All Pools” in DEXTools. This shows where the token is being traded across different decentralized exchanges or networks. Comparing liquidity across pools can help you identify where the token has the most stable price or the best liquidity for making trades.

Audit Information

Another essential feature is the Audit Scan, accessible at the top of the Pair Explorer interface. In the second screenshot, we see an audit scan with 7 alerts, which are broken down into Danger (1), Warning (6), and Neutral (8). Key audit data includes:

- Contract Verified: Indicates whether the smart contract has been verified on the blockchain. In this case, it has been verified.

- Honeypot Check: A honeypot refers to a scam where users can buy tokens but cannot sell them. Fortunately, this token passes the honeypot check.

- Buy and Sell Tax: Displays any additional fees imposed on buy or sell transactions. Here, there is a 2% buy tax and 1.9% sell tax, which are fairly standard in many DeFi projects.

- Proxy Contract: Shows if the contract allows the owner to make changes to the code. In this case, the proxy contract check shows No, indicating that the contract is immutable, meaning it cannot be altered by the developers.

- Mintable: Checks if the contract allows minting of additional tokens. For this token, minting is disabled, meaning the supply is fixed, which can be a positive sign for long-term investors.

To get the most out of DEXTools, consider the following expert tips:

- Leverage Whale Tracking: By keeping an eye on Big Swap Explorer, you can spot whales’ trading behaviors early and adjust your positions accordingly.

- Create a Watchlist with Favorite Pairs: Adding tokens to your favorites list provides quick access to your key assets, saving time and allowing you to focus on important trades.

- Utilize Desktop and Telegram Alerts: Set alerts based on your trading strategy. For example, day traders may benefit from tighter price alerts, while long-term holders may prefer broader volume-based alerts.

- Regularly Review Wallet Tracking: Monitoring high-performing wallets can reveal patterns and strategies that can inform your trades.

- Utilize Technical Indicators: With built-in technical analysis tools, use indicators like MACD and RSI to refine your entries and exits based on market momentum.

When compared to other platforms like Uniswap.info, PooCoin, Bogged Finance, and Dexscreener, DEXTools offers a unique combination of features that set it apart:

- Whale Tracking: One of the standout features of DEXTools is the Big Swap Explorer, which allows users to track large transactions by crypto whales. This feature is particularly useful for identifying major market movements that could impact price and liquidity—something competitors like Dexscreener may not offer with the same level of detail.

- Cross-Chain Support: While platforms like Dexscreener offer multi-chain analytics, DEXTools supports not only Ethereum but also other major blockchains like Polygon, Avalanche, and Solana, giving traders more comprehensive access to data across various networks.

- In-App Trading: DEXTools’ Aggregator allows users to trade directly within the app across multiple decentralized exchanges (DEXs), which streamlines the trading process. This is a significant advantage over competitors like Uniswap.info, which focus mainly on data and charts without built-in trading capabilities.

- Community-Driven Features: Unlike many competitors, DEXTools integrates community feedback into its development and supports DeFi projects through initiatives like DEXTForce and DEXTForce Ventures, making it more than just an analytics platform but also a supporter of the DeFi ecosystem.

Overall, while Dexscreener and other platforms provide solid analytics, DEXTools excels in offering a well-rounded suite of trading tools, real-time insights, and community-driven innovation.

Pros:

- Real-time data and analytics.

- Wide-ranging support for multiple DEXs and blockchains.

- Intuitive and accessible for all levels of traders.

- Powerful premium features for professional traders and liquidity providers.

Cons:

- Some advanced features require premium subscriptions.

- The wealth of data and features may be overwhelming for beginners.

The DeFi market is evolving rapidly, and DEXTools is committed to staying ahead by enhancing its platform with new features. Here’s what users can look forward to:

- Expanded Blockchain Support: DEXTools plans to add support for more blockchains, making it easier for traders to access liquidity pools across even more ecosystems.

- Enhanced User Interface: The team is working on making the interface more intuitive, particularly on mobile platforms, so that traders can easily manage their portfolios on the go.

- DEXTools Academy: An upcoming section for educational content, including webinars and courses for beginner to expert-level traders. This academy will empower users to make the most of DEXTools’ features.